Stablecoins have become a pivotal element within the Polkadot ecosystem, offering a stable and reliable medium of exchange amidst the volatility of the broader cryptocurrency market. As decentralized finance (DeFi) continues to grow on Polkadot, the use of stablecoins such as USDC and USDT is increasingly integral to the network’s financial infrastructure. These Polkadot stablecoins not only provide liquidity but also ensure that transactions remain stable and secure across various parachains and the Polkadot AssetHub. In this analysis, we delve into the latest metrics from DotLake, shedding light on the distribution and impact of these stablecoins within the Polkadot ecosystem.

Polkadot DAO Adds Stablecoins to its Treasury

In a significant development, even the Polkadot Treasury has begun incorporating stablecoins into its financial strategy. This move underscores the growing importance of stablecoins, such as USDC and USDT, within the network. By adding these stablecoins, the Polkadot Treasury aims to enhance liquidity management and ensure greater financial stability across its decentralized finance (DeFi) initiatives. This adoption not only reflects the increasing trust in stablecoins but also highlights their vital role in supporting the broader economic activities within the Polkadot network.

USDC in Polkadot AssetHub

USDC has been a preferred stablecoin within the Polkadot ecosystem, particularly on the AssetHub. As of the most recent data, the total sum of USDC circulating within the Polkadot AssetHub is $58.7 million. This figure illustrates the critical role USDC plays in providing liquidity and stability for users engaging in various DeFi activities on the platform.

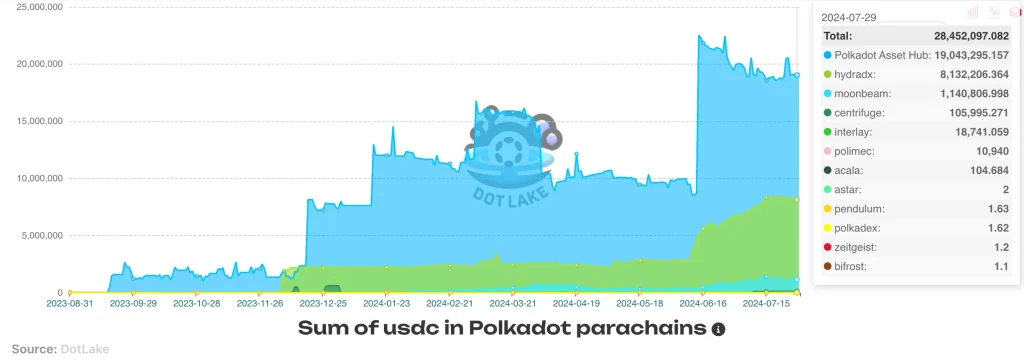

Beyond the AssetHub, USDC is also widely adopted across multiple Polkadot parachains. The aggregate amount of USDC on these parachains is reported at $162.3 million. This wide distribution of USDC underscores its versatility and importance in facilitating transactions and liquidity pools across the Polkadot network.

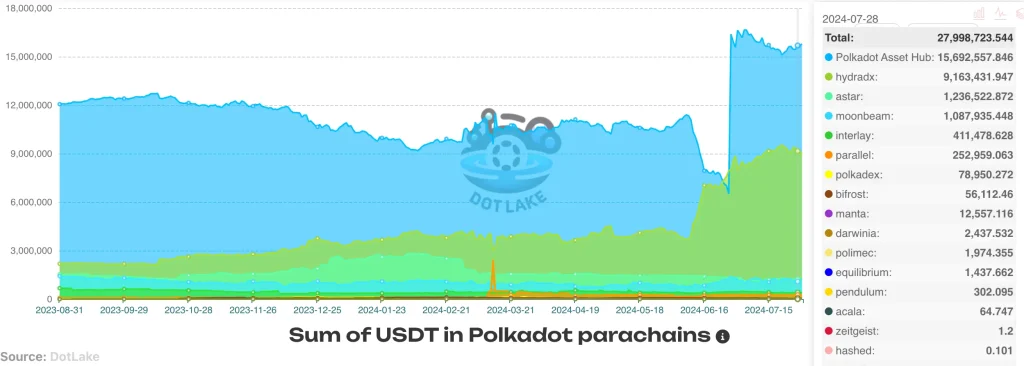

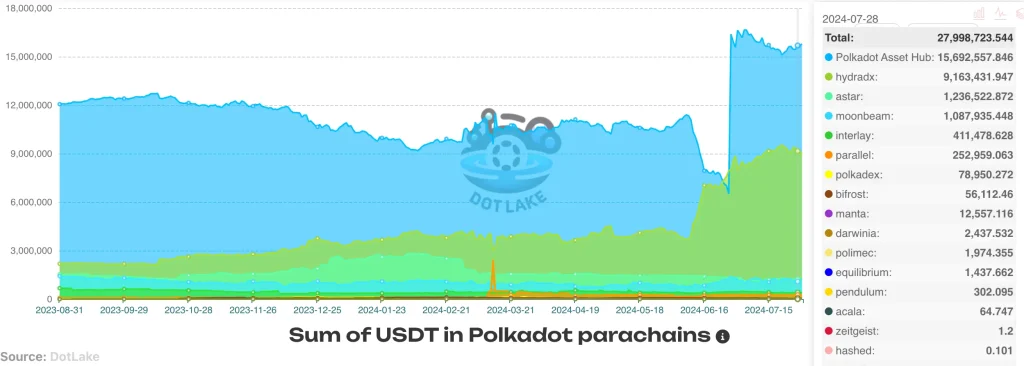

USDT in Polkadot AssetHub

Similarly, USDT has established itself as a key player within the Polkadot DeFi landscape. The total sum of USDT within the Polkadot AssetHub currently stands at $74.5 million. This substantial amount reflects USDT’s role as a primary medium for stable, low-volatility transactions within the network.

USDT’s influence extends across the Polkadot ecosystem, with its sum across various parachains reaching $194.7 million. This data highlights USDT’s broad acceptance and critical function in maintaining liquidity across numerous DeFi platforms and applications within Polkadot.

Conclusion

The presence and distribution of USDC and USDT within the Polkadot AssetHub and across its parachains are clear indicators of the significance of these stablecoins in the network’s DeFi environment. With $58.7 million of USDC and $74.5 million of USDT in the AssetHub alone, coupled with their extensive sums of $162.3 million and $194.7 million across parachains respectively, it is evident that these stablecoins are foundational to Polkadot’s financial infrastructure.

As the Polkadot ecosystem continues to mature, the role of stablecoins like USDC and USDT is likely to expand, further solidifying their place as essential components for ensuring liquidity, stability, and interoperability across decentralized finance. These metrics, sourced from DotLake, provide valuable insight into the growing reliance on stablecoins within Polkadot, emphasizing their importance for the network’s users and developers.